For decades, Disney Corporation has been a lot more than Mickey Mouse and the Magic Kingdom. The company has ventured in recent years into many areas that aren’t necessarily considered child entertainment. Still, there’s no question about Disney’s dominance in theme parks and animated movies, but can it also become a major force in sports betting?

In August 2023, Disney-owned sports media company ESPN announced it was making a move into the regulated US sports betting market, which is now legal in 38 states. A $1.5 billion deal was signed between gambling company Penn Entertainment and ESPN. And on November 15, 2023, the new sportsbook ESPN Bet was launched in 17 states.

The group expected a pretty easy entry into the market, even though it’s highly competitive. ESPN is the United State’s biggest sports media brand. The company has more than 105 million unique visitors on its digital channels every month. Its social media channels have more than 370 million followers, and its streaming service, ESPN+, has more than 25 million subscribers.

ESPN Chairman Jimmy Pietro said: “Our primary focus is always to serve sports fans, and we know they want both betting content and the ability to place bets with less friction from within our products. The strategy here is simple: to give fans what they’ve been requesting and expecting from ESPN. Penn Entertainment is the perfect partner to build an unmatched user experience for sports betting with ESPN Bet.”

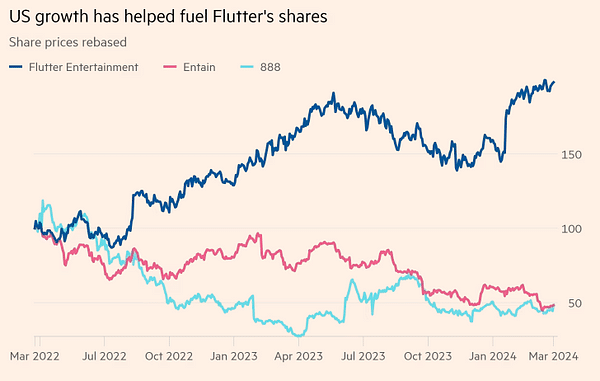

But in the meantime, one of ESPN Bet’s main competitors, Flutter Entertainment, owner of FanDuel, shows explosive growth, with stock prices rocketing and outperforming other companies in the marketplace.

Key Points to Note:

- ESPN Bet posted modest revenues of $31.5 million in Q4/23

- Penn Entertainment posted a $358.8 loss for the quarter, stating that the loss came from an investment in ESPN Bet.

- FanDuel earned Flutter $4.4 billion in revenues in 2023, up from $3.1 billion in 2022.

- FanDuel reported an EBITDA of $65 million for 2023, compared to a $347 million loss in 2022.

- Flutter Entertainment generated $11.7 billion in 2023, a 24.9% increase year-on-year.

Ziv Chen, a contributing writer to thesolitare.com said: “The US sports betting market is new; it’s only been around since 2018, and every state rolls out its regulated sports betting market gradually, once it is signed into law. So there’s a process of being first on the ground, educating customers, building trust, signing sponsorships with local teams and organizations, and more. FanDuel and DraftKings have been doing just that, so ESPN Bet certainly has a place and potential to grow, but it needs to be patient and understand that first-mover advantage counts, and they weren’t there first.”

SOURCE www.thesolitaire.com and www.rizeandreactmedia.com